The Art of Adjustment

Whether it’s OKC’s unselfish system, Roland-Garros’ brutal clay, or a drifting Philippine stock market—winners adapt early, trust the system, and get paid to wait.

Days of Thunder

They’re calling it a rebuild year. The Oklahoma City Thunder weren’t supposed to be here. Not in the NBA Finals. Not this fast. Not with this much poise. But they are—because they figured something out. Play like a system. Adjust like a surgeon. Trust the damn plan. And that’s not just basketball. That’s clay-court tennis. That’s investing in 2025. That’s life when the ground won’t stop shifting.

On Clay Courts & Crossroads

On the red dirt of The French Open, every bounce of ‘La balle’ can be deceiving. Topspin kicks higher. Slides don’t forgive. Big serves slow down. You don’t dominate clay. You adjust to it—shot by shot, point by point. It’s ugly. It’s slow. But the ones who win? They do it without losing their form.

Ask Jannik Sinner. Ask Carlos Alcaraz. They aren’t just playing their game. They’re reshaping it, adjusting mid-match, to survive the surface. Just like OKC. Just like the best investors.

Drift Isn’t Death—It’s Discipline Training

Meanwhile, the Philippine stock market isn’t crashing. It’s drifting. The PSEi ended May nearly unchanged at 6,341.53—flatline, but full of noise. It’s volatility without direction. News without follow-through. Signals without conviction. We had:

Tailwinds: Positive surprises in 5-year low in inflation (1.4%) and Fitch’s reaffirmation of our credit rating

Headwinds: Weak GDP growth (5.4%), soft 1st quarter corporate earnings growth of 5%, weak Foreign Direct Investments, a US credit outlook downgrade, foreigners net sold $249M out of PH equities.

And the average daily turnover? $114M. A ghost town.

So, what do you do in a market that refuses to give you a clear signal? You follow what the pros, the clay-court killers, and the Thunder all know:

You stay patient. Stay paid. Stay ready.

GREAT Says Wait

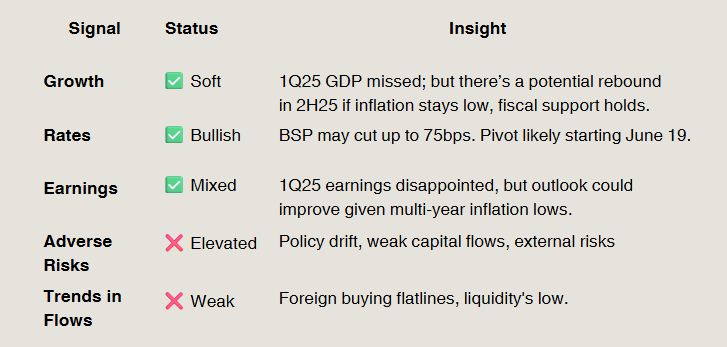

Let’s check in with the GREAT Framework, my system for reading market weather.

Conclusion? GREAT score of 3—Neutral. Stay Nimble. This isn’t an all-in moment—it’s a sniper’s market.

Paid Patience: How Winners Wait

This market isn’t rewarding flash. It’s rewarding patience with a payout. In times like these, the playbook remains simple: You don’t chase the trade. You own the cash flow— welcome to the Paid-to-Wait Era.

High-dividend stocks are your friend. They offer cash flow, stability, and a strategy that rewards you without betting the farm. Combine the top 5 names in your portfolio by equal weighting them or you can also use the JT Criterion—my position-sizing tool. But that’s for another day, and another dynamic discussion. So, who pays you to wait, without significant concerns on quality?

REITs

RL Commercial REIT: 6.5% | Diversified footprint, Resilient base.

Citicore Energy REIT: 6.1% | Unique Green portfolio, Resilient Revenue & Growth prospects

AREIT, Inc: 6.0% | Central assets, Ayala-backed

Utilities & Infra

Manila Electric Co.: 5.5% | Healthy cash flow. steady payouts. Zero drama.

Aboitiz Power: 6.5% | Renewable energy growth kicker

Honorable Mentions

PLDT & Globe: 4.5% | Asset sales support dividends, but keep an eye on debt

Metrobank: 4.5% | Unexciting in the best possible way

Bottom line? Don’t confuse motion with progress. You’re not doing “nothing”—you’re collecting dividends while the market and the macro signals clear.

Culture Over Chaos: Why OKC Is Winning

Back to OKC. What makes them scary isn’t just Shai, J-Dub or Chet. It’s their culture. They’re quick to rotate/switch on defense and getting into the passing lanes--with purpose. They trust each other’s reads. They know when to shoot, and when to pass. No one freelances. Everyone adjusts.

That’s the edge. Culture isn’t a vibe. It’s a survival mechanism. And, it’s the same edge in business, investing, and leadership. As Sam Altman once said:

“Culture is what keeps a team aligned and able to move fast, even when the future is uncertain.”

Final Set, Fourth Quarter, Flat Market—Same Rules

You don’t need a bull market to win. You need clarity, control, and a system that doesn’t break when things drift sideways.

That’s what clay court players understand. That’s what OKC lives. And that’s what smart investors do. They don’t chase hype. They don’t overtrade boredom. They don’t confuse movement for progress. They get paid. Then they pounce.

TL;DR: If You’ve Lost Money and You’re Tired of Guessing

The real pros don’t predict—they adjust

In this market, chasing gets you hurt. Yield gets you calm.

Prefer Systems over stars. Process over hope.

This is not a “next big thing” moment—it’s a protect and position moment

If you can’t attack, collect. That’s paid patience.

And if you're still in recovery mode from your last market mistake? Good. That means you're ready to stop improvising and start adjusting. Let the noise fade. Let the dividends drip. Let your system lead.

Welcome to the new era. It's slow. It's surgical. It's smart. It’s called winning when no one’s watching.